10 Wrong Answers To Common Rigfinance.Com.Au Luke Howard Brisbane Questions: Do You Know The Right Ones?

Any time you initial started out earning your personal cash, you experienced the facility to buy nearly anything you desired. You almost certainly shopped for gadgets or garments, or perhaps bought a fresh pair of footwear you are eyeing for a month. Faster or afterwards, you'll probably begin considering getting anything more useful, still pricey, similar to a car or truck. Purchasing a automobile, even so, wouldn't be doable only by way of your wage. Making use of for your personal loan, like a utilised https://en.wikipedia.org/wiki/?search=used car loan motor vehicle personal loan, could well be your best alternative.

It's a incontrovertible fact that not everyone has more than enough dollars to order a vehicle with their salary by yourself. To order one, it is possibly they may have An additional source of cash flow or have saved up all their lives. There may be yet another way while, via a new or utilized car mortgage. Individuals would probable choose to purchase a brand-new automobile than the usual made use of one particular; nevertheless, as a result of present-day problem, selecting a made use of car is often a wise and practical selection.

Employed auto loans in a nutshell

Availing employed automobile loans gives individuals an opportunity to buy a car or truck without the need of currently being harassed of substantial desire premiums and installment charges as compared to applying to get a new car loan. It truly is suited to people who are on a good price range but are liable ample to pay for their debts. When purchasing a car, It's important to be real looking about what you can find the money for or not. Employed automobile loans are secure approaches of buying a car or truck you require Regardless of the small wage or price range.

Auto mortgage https://rigfinance.com.au/us_client/mashable/ method on-line

Go on the web and you will find numerous vehicle bank loan dealerships which provide new and utilized car financial loans, automobile financial loans for those with lousy credit rating, or refinance vehicle bank loan. Locating a lender online is handy and rapid simply because you can compare premiums from a variety of lenders by asking for no cost offers on their prices. This will help you come across fantastic phrases and bargains you can get the job done with. After getting discovered a reliable company, fill out their secured software form together with your aspects to assess your ask for.

These on-line corporations commonly take a couple hours to a couple of days to evaluate your software. This method is very rapidly when compared to classic process of automobile financial loans you have from banking institutions and credit score unions. Some firms can even get you accepted of the mortgage inside minutes. Following finding authorised, you could select the auto you would like depending on the constraints set to suit your needs and soon more than enough, you'll be driving your own private auto.

Refinancing your loan

Many people do not know the goal of refinancing your automobile bank loan. Whether it is a brand new or used vehicle financial loan, persons can have their financial loans refinanced after a couple months to receive even decrease fascination fees. A refinance vehicle loan will let you proactively make efforts to reduce your regular monthly payments and save more cash in the everyday living of your respective loan.

Employed motor vehicle loans can help you help you save the vehicle you'd like and want with no fasting on a daily basis preserving up for it. You may conveniently regulate your cash without neglecting your very own needs. Uncover an organization which provides car financial loans on the net where the bank loan course of action is simpler, speedier, and even more hassle-free.

N

A

P

Buzzwords, De-buzzed: 10 Other Ways To Say Rig Finance Equipment Finance Brisbane

After you first started out earning your personal dollars, you experienced the facility to obtain anything at all you wanted. You probably shopped for devices or apparel, and even acquired a fresh set of shoes you are actually eyeing for per month. Sooner or afterwards, you should most likely begin thinking of obtaining some thing far more beneficial, however expensive, just like a automobile. Purchasing a vehicle, even so, wouldn't be https://rigfinance.com.au/us_client/mashable/ achievable only by means of your income. Applying for just a personal loan, such as a used motor vehicle personal loan, could well be your best option.

It is just a proven fact that not Every person has adequate cash to purchase a car with their salary by yourself. To acquire one particular, it's either they may have another supply of revenue or have saved up all their life. There may be yet another way though, via a new or utilised motor vehicle personal loan. Persons would possible prefer to buy a completely new motor vehicle than a employed 1; nonetheless, due to present problem, picking a made use of auto is actually a intelligent and functional decision.

Made use of vehicle loans in a nutshell

Availing utilized auto loans provides folks a chance to buy a auto without having currently being harassed of substantial curiosity fees and installment service fees in comparison with implementing to get a new motor vehicle personal loan. It really is ideal for people who find themselves on a good spending budget but are dependable enough to pay for their debts. When buying a car, You should be real looking about Anything you can afford to pay for or not. Utilized vehicle financial loans are protected ways of purchasing a car you may need despite the very low wage or spending plan.

Car financial loan method on the internet

Go on the web and you will see many auto bank loan dealerships which supply new and utilised auto financial loans, car loans for individuals with lousy credit rating, or refinance auto bank loan. Getting a lender online is practical and fast as you can Look at prices from several lenders by requesting no cost quotes on their own fees. This will allow you to obtain fantastic terms and discounts you'll be able to work with. Upon getting observed a trustworthy firm, fill out their secured application form along with your information to assess your ask for.

These on the web companies ordinarily take a handful of hours to a few days to evaluate your software. This technique is rather quick when compared to classic means of vehicle loans you have from banks and credit rating unions. Some businesses can even get you accredited of the personal loan in just minutes. After having authorized, you could pick the car you would like based on the constraints established for yourself and soon adequate, you'll be driving your very own car.

Refinancing your financial loan

Some individuals don't know the objective of refinancing your car personal loan. Whether it is a new or applied auto financial loan, people today can have their loans refinanced following a handful of months to get even decrease interest costs. A refinance automobile personal loan can help you proactively make efforts to lessen your month to month payments and help you save more money through the everyday living of your personal loan.

Made use of vehicle financial loans will help you help you save the car you would like and need without having fasting every day saving up for it. You may conveniently deal with your cash without the need of neglecting your own needs. Uncover an organization which features auto loans on the net wherever the mortgage approach is simpler, quicker, and more handy.

N

A

P

10 Inspirational Graphics About Luke Howard Brisbane Rig Finance

Each and every auto is far more than a 4-wheeled auto. It is really proprietor's glory, enthusiasm and also a source of good admiration. Certainly, an automobile is not merely a way of transportation. It's America's pleasure and its supreme ecstasy.

When 1 sets out to purchase an auto, quite a few things are to become regarded. Most people have an notion of what auto to buy. But, There may be confusion and Problem when the topic of motor https://www.washingtonpost.com/newssearch/?query=car loan vehicle loans will come up. This article will give you a specific idea of the various vehicle financing choices available with you.

>> Money Before Everything Else <<

It's so true. You cannot undertaking out for purchasing a vehicle when you have no clue regarding your funds. If you think that car financial loans are likely to do everything in your case, Reassess. You'll have to regulate down payment and in addition make certain common payments. Car or truck loans are merely to supply simplicity in obtaining.

Acquiring that perfect motor vehicle bank loan demands you to meticulously set alongside one another your profits and bills after which preparing your price range. You'll need to take into account your savings and pick a thing that is not going to Present you with money difficulties.

>> A Plenitude Of Selections <<

Every little thing depends upon acquiring the knowledge that satisfies your predicament. So, Do not accept the first financing solution you have. Will not just stroll into your local vendor's Business office or your community lender. You need to initial do an entire study and evaluate your situation and wishes.

That can assist you make a good selection, This is the many details about car bank loan kinds. Consider the many positives and negatives of every choice. It can help you create a smart final decision.

>> Dealership Financing <<

A car financial loan using a car through the exact yard- looks far too alluring to ignore!

Most Individuals pick out dealership financing because it offers a one particular-stop Alternative. Dealers provide financial loans For brand spanking new along with utilized autos. You will need to know that many dealers are url among you and also the lender. These sellers will never themselves lend you income, alternatively will market you loan application to lenders.

This feature is easy but Be sure that dealer is not really charging a superior curiosity level. For that, it's essential to exploration and be wary of any red flags. Also, Will not choose for any include-on if you don't really feel their have to have. It can help you lessen the Charge.

>> Private Financial loans <<

Financial institutions and economical institutions give financial loans for nearly any function like obtaining a personal merchandise or even a vacation trip. You are able to avail particular loans for getting your aspiration motor vehicle. Now, this type of funding is beneficial when You'll need a bank loan for your smaller sized sum like $15,000.

>> Vehicle Leasing <<

This is certainly an alternative choice for yourself. When you lease an automobile, you only pay for the expense of applying it. The largest edge with leasing is that the regular monthly payments will be noticeably reduced than the same old vehicle personal loan payments.

You won't need to concern yourself with deposit and the lease settlement will get over in two-three many years. You usually have the choice of buying the car at the conclusion of lease arrangement.

If you Choose lease funding, don't forget to barter the vehicle price. Most prospective buyers feel that a person should spend the complete sticker cost which can be Improper.

>> Equity Loans <<

If you're a type of several Blessed people who have sizable belongings like a dwelling, you can Opt for equity loans. It is possible to avail a home equity loan by using your property as collateral.

Although the prices are reduce and also the fascination is tax-deductible, There may be the potential risk of shedding your private home.

>> Charge cards <<

Even though it may well seem unusual, but there are various who opt for this method. A charge card may help you purchase a vehicle for a lesser volume like $ten,000. You should have a reduced-curiosity credit card. With large competition, obtaining a low-Charge card won't be a hassle for yourself.

The one thing is usually that you'll need to prohibit other buys on your own card. Also, most bank card organizations charge a 3% processing charges. Should you be confident of paying this charge for the vendor, Choose it.

>> Motor vehicle Loans <<

That is as common as dealership financing, if no more. In this sort of bank loan, your automobile is utilised as collateral versus regular payments.

It is very good possibility when you make normal payments. The only thing that you choose to will need to remember is you will not likely be capable of finance a car more mature than six/seven yrs.

>> On the net Motor vehicle Financial loans <<

This type is simply the combination of vehicle loans and the net. With technological developments, you may get every little thing on the net and vehicle financial loans are not any diverse. On the internet lending providers have a sizable community of lenders and dealers who bid for your personal application. All you'll want to do is fill an easy on the net software variety.

As There's a wide network, obtaining a personal loan is fairly quick. Also, the advantage of availing a personal loan without relocating away from the home may be very tempting.

You'll want to only be worried about the organization's dependability. It is possible to Check out the website's basic safety by going through their security certification. Don't go for a company that rates for bank loan estimates because there are several dependable web sites that offer free quotes.

How To settle on That Ideal Automobile Personal loan?

Just go more than that has a good-tooth comb.

When you choose on the kind of auto loan and utilize, it's time to scrutinize the personal loan quotes. Personal loan payments are very important but it surely shouldn't be the soul of your final decision. There are plenty of aspects which are equally critical. Prior to deciding to hurry towards your final decision, Consider these variables.

Financial loan Phrase

Your bank loan phrase will have a large impact on your personal loan. An extended financial loan term will indicate that the every month payments are scaled-down, however , you might sooner or later be shelling out extra curiosity rate. It is advisable that your term https://rigfinance.com.au need to be in accordance While using the useful life of the vehicle. Your financial loan really should recover from before the life of motor vehicle in order to avoid the risk of an upside-down loan.

Interest Premiums

Interest is determined by components just like the financial loan amount, bank loan expression, credit history score, financial affliction, and so forth. One particular crucial suggestion to lessen loan fees is by producing a considerable down payment. This will minimize your personal loan amount and likewise instill a sense of faith while in the lender.

APR

The Yearly Proportion Ratio will show you in regards to the full price of the mortgage including all charges and prices. Most borrowers think about just regular monthly payments. But, it truly is extremely hard to check distinctive loan quotations with different mortgage phrases. When you Evaluate two financial loan offers with the assistance of APR, you might be using into consideration every one of the variables.

Clauses

You need to Examine bank loan quotes on The idea in the clauses during the personal loan agreements. Several lenders prohibit you from refinancing your automobile loan for the main several months. Some lenders also offer zero percent financing for the main handful of months only and afterwards demand a floating interest level. So, check for these clauses which may lead to difficulty Down the road.

Fees And Penalties

Check the mortgage deal for origination expenses, once-a-year costs, prepayment penalty and penalty for lacking out on a payment. Pick a lender that has lesser fees and would not charge you for making early re-payment. The latter will probably be helpful if you choose to refinance your mortgage.

Payments

It is important to be aware of regardless if you are speculated to make payments weekly or every month. If you're able to pay for regular monthly payment, Will not think about another option. This is so because it will give you the choice of creating standard payments with no undue financial restraints.

As you Look at quotes on these elements, you will definitely get yourself a winner. Deciding on your car personal loan by this technique may perhaps get time but what make a difference is the ease in creating payments. Each variable is important in producing your life easier as well as your car or truck obtaining experience a lot more pleasurable. So, memorize these vital tips.

Owing a car or truck is often a aspiration For numerous, but a person who normally takes a smart choice can satisfy it in correct feeling. Automobile loans won't be a difficulties if you think about your requirements and economic issue. Try to remember a fantastic final decision includes an intensive research procedure.

N

A

P

How Technology Is Changing How We Treat Luke Howard Brisbane

Possessing an auto of the aspiration is actually a reality these days. This is often thanks largely to vehicle bank loan that is definitely created accessible to Just about every and each aspirant wishing to have a auto of his possess. The lenders have saved terms-circumstances of automobile loans attractive for winning as many shoppers as you can in a tricky vehicle personal loan current market, earning the financial loan even easier to obtain. According to your specifications and as satisfies on your pocket, vehicle financial loan is there for asking to get both a completely new vehicle or a utilized one particular. But before making a offer, it would be smart to have a near look of what is happening in vehicle personal loan markets and What exactly are basic elements that 1 ought to be familiar with in getting auto personal loan.

Among the list of interesting aspect of each car or truck bank loan is that you do not have to search for a collateral is secured car loan is your selection. it might be a lot more advantageous if you can position any of the beneficial belongings like household as collateral Together with the lender. But If you don't choose to danger household to the panic of its repossession, then the very car or truck you intend to get can certainly secure the personal loan. all you have to do is at hand over the offer papers of the car for the lender who will return them When you have paid back again the personal loan completely. Meanwhile you could go on driving your automobile. But in case of payment default, you'd probably be getting rid of vehicle to the lender.

Secured car personal loan have this benefit of lessen desire prices and if your own home secures the loan, the speed of desire goes down. The loan sum depends on fairness in collateral like household or the cost of the car. are car finance payments frozen Brisbane Whilst you push the vehicle, the stress from the bank loan is lesser as the vehicle personal loan is usually repaid in 5 to thirty yrs. Bigger repayment length means you may lessened regular payment in direction of installments.

Tenants or non-homeowners on the other hand can go for unsecured car personal loan. Unsecured motor vehicle loan comes with no clause of collateral, earning the mortgage a very risk totally free affair for that car proprietor. As you'll find dangers to the lender, unsecured auto loan come at bigger curiosity amount rendering it costlier for your borrower. Unsecured automobile mortgage is solely made available on the basis of financial standing of tenants or non-homeowner. Earnings and work documents are needed with the borrower for making sure Risk-free return from the bank loan. you will end up accredited smaller amount for the shorter repayment duration as unsecured car loan.

Tend not to concern yourself with undesirable credit. In case of secured car or truck mortgage, as lenders provide the borrower's property as security, terrible credit rating isn't going to issues Significantly on the lenders. For unsecured car personal loan even so money and employment files are should for demonstrating towards the lender. But undesirable credit borrowers will probably be authorized the vehicle mortgage at greater curiosity price. Simultaneously 1 need to Observe that if car mortgage installments are on a regular basis cleared, the borrower's credit rating rating goes bigger and personal loan availing in long run becomes a lot easier.

Buy a auto from a reputable automobile dealer and Test it for mechanical defects and high-quality. Evaluate unique motor vehicle financial loan companies which have showcased automobile bank loan fascination charges and terms-circumstances on Sites. Apply into the appropriate lender on line for a fast processing and approval of car or truck loan. Be sure to pay off bank loan installments in time for escaping debts.

N

A

P

17 Reasons Why You Should Ignore Rig Finance Brisbane Rig Finance

Professional personal loan brokers should offer a genuine company for their clientele. An emphasis needs to be on preserving their clientele time, aiding them keep away from aggravation, high-priced faults and naturally, must be capable to line http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/commercial loan up the right lender into the borrowers one of a kind scenario. Bottom line, the broker's prior experience ought to assist guidebook the borrower, who may have little or no experiencing sourcing, negotiating, processing, and shutting a business house loan.

Among the a lot more useful factors of what a great industrial financial loan broker does, is introduce the borrower to lenders they'd by no means, (realistically) be able to find by themselves. There is a entire market place of business lenders on the market that do not need branches and as an alternative depend on their broker networks to discover discounts and introduce Resourceful/exclusive courses that standard banking companies will not offer you (like industrial said cash flow financial loans, commercial thirty yr set or 2nd lien placement financial loans, etcetera).

Additionally, brokers really should have the capacity to give their consumers solid, significant suggestions on which unique lenders in shape the borrower's predicament. The actual discrepancies from a single lender to the next could be quite challenging to uncover. You can find apparent elements, for example which banks are quoting the lowest fees, presenting the longest amortization schedules, longest fixed intervals, and so forth. But the issues that could possible kill or change mortgage phrases in the middle of processing a loan are only learned via expertise. This is where a commercial financial loan broker seriously earns his cost which intricate lender awareness is just learned by being concerned over a everyday basis. A great business personal loan broker closes two -4 financial loans per 30 days, while a borrower will only near two-4 within their lifetime time.

Brokers are fundamentally on a similar facet from the table as their customers. Whilst there is no Formal illustration arrangement like a listing settlement, a broker ought to be there with their borrower's interests in your mind. On top of that, not like financial institution financial loan officers, brokers only receives a commission when the financial loan closes. We get paid to close financial loans. Quite a few lender officers in contrast are on salaries and have other quotas Other than funding loans, like weekly meeting targets, variety of telephone phone calls created, turned in programs, and so forth. So the lender officer might know that your financial loan stands little to no possibility of closing nevertheless will "direct you on" only to protect their career (this comes about continuously!).

An excellent broker will create a competitive ecosystem with funding click here sources to create the best rates and lowest expenses feasible for his or her consumers. The brokers standing with financial institutions may also increase to this in that if the broker is known, the funding source will go ahead and take mortgage request more severely, place a lot more time and Power to the file. Lenders also will never "re-trade" as speedily with very good brokers in concern the broker will likely not bring the bank supplemental loans.

Brokers truly worth their "salt" must manage to discover the best options for the borrower based upon tiny intricacies from the file. Normally, it really is a little detail that may sluggish or get rid of a deal. A stable broker ought to be capable of discover these details from the start that might in any other case Price tag the borrower countless numbers, and waste months as the wrong lender tries to make the file suit their guidelines

N

A

P

The History Of Luke Howard Brisbane Rig Finance

Secured Loans

Exactly what is a Secured Bank loan and What exactly are the challenges?

A Secured Personal loan is a financial loan secured over the homeowners property greatly in the same way for a Mortgage is. A Mortgage loan on a residence is named the "1st Cost" - a Secured Personal loan for that reason gets the "2nd Cost." If a Secured Personal loan is never paid then certainly the Homeowners house is in danger. Together with the Property finance loan firm having the 1st charge they thus reclaim their funds very first. A Secured Personal loan Lender would then follow as they are the 2nd cost. It is value remembering that a Home loan and Secured Bank loan Corporation would only at any time repossess a assets as a last vacation resort.

A Secured Bank loan is perfect for Homeowners who want to elevate finance by using their household as protection. Usually a Secured Loan can provide Homeowners by using a lessen APR than that of the Unsecured Mortgage. Obviously a Personal loan Lenders APR varies with regards to the private circumstances with the applicant. A Secured Personal loan can be employed for various needs. The most typical Secured Personal loan functions are for House Enhancements and for Credit card debt Consolidation.

Residence Advancement Secured Loan

A loan that's secured on the applicants house address for the https://rigfinance.com.au goal of Household Advancements. The financial loan may be used for the new conservatory, renovations, extension or simply for double glazing. Nearly any kind of home enhancements might be funded by a secured personal loan. You could possibly discover that some secured personal loan lenders would require evidence of what you will end up using the money for. This may be supplied by merely getting a published quote from someone who you need to have the do the job finished by. Chances are high a Home Enhancement Secured Mortgage will basically increase the value of your assets so it will be funds effectively invested.

Debt Consolidation Financial loan

A personal loan that is definitely secured to the applicants property address for the objective of Financial debt Consolidation. The mortgage is normally utilized to consolidate (pay off) all current credit score by putting it into a person secured mortgage and this typically minimizes the monthly payments and for that reason frees up additional of your respective monthly money to use For additional enjoyable applications than clearing credit cards, store cards, loans or employ the service of buys! In some cases the sole way during which the regular payments is often minimized is by getting the Secured Personal loan in excess of a longer interval than what the present credit is presently on. This will improve the amount in complete that you're going to pay back but customers who have a Credit card debt Consolidation Loan frequently tend to be more thinking about the minimized regular monthly outgoing on credit rating.

A Secured Mortgage can be employed for other needs Other than Personal debt Consolidation and Home Enhancements. They may also be utilized for a Car, Holiday break or Wedding. Commonly Secured Loan lenders tend not to increase finance for Enterprise. For a Business Bank loan it may be a better route to Speak to your local Lender or Making Modern society.

Why would i need a Secured Personal loan instead of an Unsecured Mortgage?

There are many main reasons why.

Repayment Interval

A Secured Financial loan can Generally be taken above a longer period of time than that of the unsecured private personal loan. Unsecured Financial loans can normally only be taken more than a maximum of seven or ten years. Some Secured Mortgage Lenders allows the applicant to take the finance over a 30 12 months time period and many allows the finance to become spread more than 25 decades well worth of payments. Clearly by getting the personal loan over an extended time period reduces the monthly payment to the applicant - Despite the fact that it's essential to don't forget the lengthier you go ahead and take bank loan over the greater desire you will pay.

Mortgage Volume

A Secured Loan sum can generally be a whole lot greater than that of the unsecured individual loan. Secured Loans could be taken as much as £one hundred,000 - with some lenders even enabling applicants to borrow a lot more. An unsecured mortgage lender will normally only lend nearly £25,000 which occasionally just is not enough. We could surprise you with the amount you can actually borrow. Let Financial loan Machine do the labor to learn.

Poor Credit rating

When you've got bad or adverse credit score then the chances you may have of receiving an unsecured particular personal loan are really slender. Poor or adverse credit rating can include a lot of things, CCJ's (County Courtroom Judgements), Defaults, Mortgage Arrears, IVA's, VAR's, Discharged Bankrupts and Skipped Credit rating Payments. When you've got any of these then your best route for gaining finance could perfectly be by using a Secured Mortgage. These Never necessarily avert you obtaining a Secured Loan - there are several lenders that will lend even When you have a mix of CCJs, House loan Arrears and Defaults. We may surprise you by finding a bank loan which you did not Feel you'd be able to get. Let Financial loan Equipment do the labor.

Fairness

Fairness inside your assets will assist you to obtain a Secured Financial loan but that does not imply You need to have fairness to obtain a Secured Bank loan. Mortgage Device has usage of lenders which will lend finance above and over and above what your home is presently really worth - although To accomplish this you usually have to possess a fantastic credit rating ranking. But what Have you ever obtained to get rid of? We could shock you by getting a personal loan you failed to Consider you would be able to get. Enable Personal loan Equipment do the hard work.

Self Employed

Self Used people can often locate it quite challenging to raise finance. Secured Mortgage Lenders open up the door on the Self Utilized. They provide the opportunity to Self Certify your income. So Even though you haven't been self used for prolonged or You can't demonstrate your profits by using accounts then that doesn't suggest you cannot obtain a bank loan. If you're Self Employed with negative credit score or adverse credit you could possibly think You can't get yourself a mortgage - this is not essentially real. We may shock you by locating a loan that you simply didn't Feel you'll have the capacity to get. Let Mortgage Machine do the labor.

Small Earnings

Although all lenders will only lend responsibly to those who can find the money for it, Secured Mortgage Lenders commonly tend to be more flexible within their standards. Some Secured Loan lenders will Allow you utilize Disability Residing Allowance, Incapacity Gain, Performing Family Tax Credit rating and many other incomes to fund a personal loan application. We could surprise you by getting a personal loan that you did not think you would be able to get.

N

A

P

10 Things We All Hate About Are Car Loans A Bad Idea

Every sector, be it significant or compact is quite dependent on the transportation program. It doesn't seriously occur being a surprise that the need for even larger vans is going up with each passing working day. You can Plainly demonstrate this by The point that each marketplace product bought or marketed globally tends to make superior usage of vehicles. With the development in the sector technology, trucks are getting to be far more gasoline effective because of the working day making it a desire for that transportation facility around the world.

The pocket pinch whilst getting a single of such vehicles could be quite hefty, making finance an complete necessity. Receiving the ideal finance corporation that may help you by using a truck is not a fairly easy task Primarily due to major sum of cash included. The sellers typically have tie ups with financers that can assist you out With all the truck finance. Otherwise then you can simply technique one of several many finance organizations offering truck financial loans. An index of such businesses can be found Using the truck vendor and is usually offered on the net. The concern now could be about the requirements for gaining the truck lease.

There are two fundamental different types of Truck Loans currently available, i.e. secured and unsecured.

Secured Financial loans: This kind of a loan would require you to put a handful of within your assets like your home, auto, or office as collateral. These property from the celebration of non payment in the loan is often forfeited by your financer. This is the far more favored form with the lenders but is not really a fairly easy occur in terms of non-homeowners and lousy credit history holders are anxious.

Unsecured Mortgage: This kind of a financial loan isn't going to need you to put collateral and is particularly apt for non-homeowners. The lender below operates the potential risk of not obtaining his a reimbursement. The same old repayment period is five to 7 years. Such a mortgage is not really easy to obtain since you aren't turning in nearly anything as collateral. Your financer will need to be confirmed you are in a financial condition to repay the mortgage. You'll need to possess a position with a regular excellent payment. Your credit history data will also be scanned for checking how you've got taken care of your credits in the past.

Australian truck finance is pretty current market pleasant For a long time along with other international locations are following its instance much too. Commonly the financers request files like Driving Licence, Medicare card, and so on. The motor vehicles coverage papers can also be essential. Several of the new truck financial loans offer you to incorporate the insurance policy inside the mortgage amount. Bank statements and your credit score background is going to be One more essential requirement. The financer will likely have an interest in checking your listing of assets to ensure that you've got a properly to carry out background. Commonly a guarantor and two or three neighborhood references is also a requisition for the financers. On a median a deposit Luke Howard Brisbane rigfinance.com.au of around twenty% will be demanded although getting the mortgage as well as repayment time differs from 2 to seven yrs.

N

A

P

This Is Your Brain On Types Of Personal Loans

At times we'd like extra cash to finance a Specific venture, similar to a excursion, an anniversary gift or just to go shopping. Other moments the necessity of extra money emanates from an crisis similar to a broken car or truck or an Pretty much because of bill that should be paid out. Whatever the problem is, a private mortgage is usually a fantastic and rapid solution.

What Forms Of private Loans Are Made available?

We will start out by separating individual financial loans into two classes: lasting financial loans and short term loans. In just long term financial loans, you've got secured and unsecured financial loans. Repayment conditions fluctuate based on the asked for quantity, you may have one or two months terms or up to ten decades. It could fluctuate, and will even depend upon the picked personal loan plus the lender's conditions. Short term loans, in the other hand, are supposed to clear up urgent desires, these financial loans' repayment conditions are not than a number of years.

Long Term Personalized Financial loans

The commonest of those financial loans are secured and unsecured individual financial loans; secured loans are depending on a collateral that actually works for a protection measure for your lender. Collateral could be, depending upon the requested quantity, a household, a vehicle, or every other product which will include the quantity of the personal loan is one area transpires and you are not capable of repay it.

These loans are based upon your credit score data. In case you have a fantastic credit rating score you can request an increased sum of money than Should your credit rating is just not so excellent. The good matter Should your credit just isn't adequate, is usually that even though You can not borrow a large amount of cash you can nevertheless be suitable.

Secured loans can have really easy fascination rates and costs. You may additionally discover wonderful repayment ailments. You simply have to search for various lenders and decide which mortgage is a lot more like what you are trying to find.

Remember to get to understand each of the terms and conditions of that loans you are contemplating to apply for. Some lenders may well demand you a penalty rate if you propose an early repayment.

Unique from secured financial loans, unsecured loans don't demand a collateral to secure the repayment. These financial loans are usually just a little costlier, For the reason that lender is using additional hazards. The borrowed amount will always be lower than the amount made available which has a secured personal loan, and this will likely also depend on your credit rating rating. Frequently, repayment terms provided for unsecured financial loans are shorter than All those terms offered for secured loans.

Short-term Own Financial loans

As claimed ahead of, these financial loans are meant for those unexpected cases that have to have rapid methods. Within this team we will location, short term private financial loans and payday financial loans.

Short-term personal financial loans are built to provide a minimal amount of cash, which is around $twenty,000 according to the lender, and typically ought to be repaid in now not than five years. According to the lender, it is possible to be asked for to position a collateral or not, so as to utilize. These financial loans have better interest fees than long-lasting financial loans. As increased your credit rating rating is, greater would be the loan situations you will be able to get.

Payday financial loans are one other possibility in short term financial loans. These kinds of financial loan's terms are no longer than two weeks, and also the borrowed amounts of funds aren't very substantial. As repayment phrases are not any lengthy, you'll be eligible Despite undesirable credit history. Needless to say, with a good credit score report, you will get better ailments.

It is possible to seek out a lender on-line https://rigfinance.com.au/us_client/upsolution/ and implement from the Laptop. The response is sort of fast and you can provide the requested dollars as part of your banking account exactly the same day you fill while in the forms. The only need is to offer your bank account aspects. You'll be able to either repay the money with your lender's Office environment or give your authorization for having the a refund from your banking account to the bank loan's owing day. Some lenders may additionally require you to leave a signed look for the financial loan's amount like a collateral.

Personal Loans Near Me : All The Stats, Facts, And Data You'll Ever Need To Know

In some cases we'd like more money to finance a https://rigfinance.com.au/us_client/upsolution/ Distinctive project, like a excursion, an anniversary present or perhaps to go shopping. Other situations the need of extra money arises from an emergency just like a damaged car or an almost due Invoice that must be compensated. Regardless of what the specific situation is, a personal personal loan can be quite a fantastic and quickly Remedy.

What Types Of Personal Financial loans Are Made available?

We will start out by separating individual financial loans into two types: lasting loans and short-term financial loans. Inside long term financial loans, you've got secured and unsecured loans. Repayment conditions change in accordance with the requested amount of money, you might have a few months conditions or up to ten a long time. It may well vary, and will likely rely upon the picked out personal loan as well as the lender's ailments. Short-term financial loans, in the opposite hand, are supposed to remedy urgent wants, these loans' repayment terms are no longer than a few years.

Long run Private Financial loans

The most typical of those loans are secured and unsecured private loans; secured loans are according to a collateral that actually works to be a protection evaluate with the lender. Collateral can be, dependant upon the asked for volume, a household, an auto, or almost every other merchandise which will go over the quantity of the personal loan is a thing takes place and you are not capable to repay it.

These financial loans can also be dependent on your credit records. Should you have a superb credit rating rating you can request a better amount of money than In the event your credit is not so very good. The great point When your credit rating will not be adequate, is the fact regardless if You can not borrow a huge amount of cash you will continue to be suitable.

Secured loans may have incredibly easy desire fees and costs. You might also find fantastic repayment disorders. You just have to search for different lenders and pick which personal loan is much more like Whatever you are seeking.

Make sure to get to grasp the many terms and conditions of that loans that you will be considering to submit an application for. Some lenders may cost you a penalty price if you propose an early repayment.

Diverse from secured financial loans, unsecured financial loans don't need a collateral to safe the repayment. These loans are usually a bit dearer, Considering that the lender is using much more challenges. The borrowed volume will always be reduce than the amount available by using a secured mortgage, and this may also depend on your credit history score. Typically, repayment phrases offered for unsecured financial loans are shorter than Those people phrases offered for secured loans.

Temporary Individual Loans

As explained prior to, these financial loans are meant for those sudden conditions that have to have fast answers. With this group we can place, temporary own financial loans and payday loans.

Temporary private financial loans are built to present you with a constrained amount of cash, that's all around $20,000 according to the lender, and frequently ought to be repaid in now not than 5 years. Depending on the lender, it is possible to be requested to put a collateral or not, as a way to use. These financial loans have increased interest fees than long-lasting financial loans. As greater your credit history score is, much better would be the bank loan situations you should be able to get.

Payday financial loans are one other solution in temporary loans. These types of personal loan's conditions are not than two weeks, and also the borrowed amounts of revenue are certainly not very substantial. As repayment phrases aren't any lengthy, you can be qualified Despite having undesirable credit history. Certainly, with a very good credit score document, you will get improved disorders.

You are able to hunt for a lender on-line and utilize from your Computer system. The reaction is almost fast and you'll have the requested dollars with your checking account the exact same day you fill during the sorts. The one requirement is to supply your banking account information. You could either repay The cash within your lender's Place of work or give your permission for getting the a refund out of your checking account on the personal loan's due day. Some lenders may have to have you to depart a signed check for the bank loan's amount as being a collateral.

What's Holding Back The What Is A Car Finance Company Industry?

Aquiring a new car or truck is among the biggest achievements that a lot of people might have. Besides funding instruction and buying a home, there is admittedly nothing at all else that may Examine to the massive expenditure that includes paying for a new car or truck.

As a result, just a few people can really find the money for to buy a car outright. A lot of people trust in motor vehicle funding as a way to buy a new car or truck. But with the many vehicle financing solutions offered currently, it truly is smart to study totally for your car or truck financing firm that provides the top prices.

Most auto financing organizations present far better specials in comparison to nearby automobile sellers. Although it is convenient to acquire your automobile supplier present you with the loan and plan, it remains far better to acquire pre-approval from a auto financing firm since they offer extra sensible desire prices and payment possibilities. To choose the motor vehicle funding company with which to perform your transactions, You will need to take into consideration two points: their rates and reliability.

Vehicle funding businesses change over the desire charges they provide to clients. If they have got found that you have superior credit history, the interest price on your car financing bank loan may not be as large when compared to someone with undesirable credit history background. And when you really need to safe motor vehicle funding with reduced interest rates, it is best to try seeking an internet vehicle funding enterprise. By making use of to your financial loan on line, you help you save the organization time and expense, As a https://rigfinance.com.au/us_client/upsolution/ result the cost savings from the expense of carrying out organization are passed on to you personally.

On top of that, It's also wise to Verify the credibility of the business, In particular if you wish to do your transactions on the net. You have got to make sure that the corporation you end up picking has been in operation For many years. Besides this, It's also possible to talk to your colleagues and mates who've by now secured vehicle funding from the car or truck funding corporation with regards to their encounters in loan application. They could recommend a suitable corporation to you.

Locating a car funding corporation in your personal loan software might be difficult if you do not understand what to contemplate and exactly where to get started on your search. But in case you go on the web and talk to dependable resources for their suggestions, you can easily Assess motor vehicle financing charges and choose the most beneficial deal for yourself.

The Evolution Of Auto Finance

You're available in the market to obtain a whole new auto and that's great. These days most Every person buying a new car or truck will need some form of auto financing and when you find your personal funds or credit rating are a lot less than excellent, you'll be able to nevertheless get a very inexpensive car funding if you know how.

An knowledgeable vehicle purchaser is a brilliant auto customer. Once you know your automobile financing selections and you've got your car financing arrange and permitted prior to deciding to talk with any gross sales person, you can stroll right into a car dealership and negotiate a better deal on your conditions with out experience intimidated, irrespective of your monetary situation.

If you recognize that you've certain credit difficulties, you need to realize the distinctions involving bad credit score automobile financial loans and certain car funding.

Undesirable Credit rating Vehicle Loans...

Lousy Credit score Automobile Financial loans typically have already been out there by means of new motor vehicle dealerships on the purchase of a completely new auto or even a pre-owned Qualified utilised auto. The particular car bank loan financing paper-operate is managed on the dealership but normally, the undesirable credit rating vehicle bank loan finance agreement is sold off to a different lender. That lender will maintain and service your personal loan. Loans typically Have got a expression of 24 months up to sixty months. The downsides to a nasty credit history auto bank loan are that a lot of franchise car or truck dealerships are usually not set up to rearrange these variety financial loans in-house, desire fees and price can vary widely and limit your auto acquire choices.

Assured Vehicle Funding...

Certain Vehicle Financing differs from the undesirable credit rating car loan largely in that this sort financing is obtainable directly by lesser or independent car services. Your finance contract is supplied by the particular automobile wholesale vendor and the bank loan is compensated directly to the auto supplier that marketed you the car. Quite simply, you would be financing your automobile invest in from the organization that owns it and marketed you the car. Assured automobile funding is employed for the acquisition of utilized or pre-owned motor vehicles and not typically for purchasing a brand-new vehicle or truck. Personal loan conditions are shorter than far more regular automobile loans they usually almost never present phrases in excess of 36 months.

The big edge to guaranteed auto funding is That usually no credit score Verify is necessary to obtain this financing. Payments are Commonly produced weekly and at times in man or woman. A person downside to this sort of vehicle loan is that numerous car dealers offering certain car financing will never report your credit score on the credit rating https://rigfinance.com.au/us_client/upsolution/ bureaus. Therefore if you are making payments on a regular basis and setting up an excellent payment historical past, this will not be mirrored in increasing your individual credit history profile or your credit history score.

Your very best method will be to begin now and find out what financing options can be found for yourself. You'll find exceptional specialized automobile funding providers obtainable on-line currently which offer an entire array of economical car or truck bank loan courses whether or not you have been turned down for funding or you might have poor credit score, lousy credit or other financial things to consider, you may be surprised at how they will let you to acquire a new automobile.

You see now there are key differences in between a foul credit rating car or truck financial loan and assured vehicle financing and you can find other funding options Apart from these. Get permitted for the most effective car personal loan to suit your needs initially, then wander into the car or truck sellers and negotiate on your conditions.

15 Secretly Funny People Working In What Is Asset Finance

Asset finance will allow businesses to gather money for the acquisition of belongings they may want to make their businesses operate effectively. Occasionally, paying a massive level of money at 1 time for buying belongings is usually seriously tricky to manage. What's more it will considerably have an impact on the company's working funds. With asset finance you can increase the money to purchase belongings and the money might be returned to your finance corporation by way of common payments over an agreed timeframe.

Asset finance may be used for paying for new and utilised automobiles, coaches, light-weight and weighty commercial automobiles, plant equipment and Business office gear. With the help of asset finance options, You should buy products for your company with no expending a big sum in a single go.

Quite simply, it will save you from The difficulty of arranging a large amount of cash for getting A great deal wanted property.

Main Kinds of Asset Finance Available in the united kingdom

Employ Obtain

This typical credit facility is available wherever the financier permits the hirer the right to possess and use an asset in return for normal payments. Below, the hirer initial finds the asset he wants and negotiates the purchase rate While using the supplier.

After the hirer pays a deposit of ten-20% towards the finance business, he normally takes the asset straight from the provider. Following a balloon payment is produced at the conclusion of the phrase, the title of the products is transferred on the hirer.

Lease Obtain

Lease Buy is frequently confused as a regular lease. It is comparable to some seek the services of purchase settlement with the one distinction remaining that in a Lease Order the hirer ought to spend a deposit of 10-fifteen% to be a numerous in the repayments. The payment for that remaining balance and desire is completed in instalments.

Moreover, a Lease Obtain settlement relies on possibly a hard and fast or variable fee. The month-to-month instalment could be reduced through the inclusion of a balloon.

Deal Retain the services of

In Contract Retain the services of, a rental settlement is created amongst the provider and the customer. In this article The shopper hires the asset for a fixed length of time and following the completion on the interval, he returns the asset for the giving vendor. With agreement hire, The client will get the prospect to implement The brand new asset without the threats linked to possession.

Finance Lease

With finance lease, just one could possibly get around a hundred% finance for the acquisition of plant gear expected in a company. Below, the ownership of the products remains Together with the finance business which rents the products into the hirer in excess of a predetermined period. Initially, the hirer ought to fork out the documentation payment and an First payment of the numerous of rentals. https://rigfinance.com.au/us_client/upsolution/ The remaining price of the asset is compensated back again in excess of the agreed time period.

Working Lease

Below an agreement is produced to rent the asset for business enterprise needs for just a predetermined time period. On the expiry of the agreed lease, the asset is both returned for the financier or an offer to acquire it for a mutually agreed rate is produced. A person big line of difference between an functioning lease and also a finance lease is the fact the first rental time period for an operating lease will not deal with the many money fees and also the retain the services of prices.

Looking at these several kinds of asset finance, it would not be tricky to pick one for purchasing high priced devices devoid of forking out an enormous sum of money at 1 go. But it is essential to comprehend asset finance and its a variety of varieties adequately before making use of for it.

There are plenty of finance organizations which can help a person to receive competitive and tailor-made asset money methods to match 1's own and enterprise necessities. It really is highly recommended to consider professional aid in order to avoid any sort of complications Down the road. One particular may take assistance from any reputed asset finance primarily based consulting firm to obtain an even better deal for one particular's enterprise.

7 Simple Secrets To Totally Rocking Your Get Equipment Finance

Have you tried functioning a company? It's a tough job, isn't really it? Should you have practical experience Within this region, You may have previously https://rigfinance.com.au/us_client/wired/ comprehended the functionality of finance. There's no business to choose from which can roll or increase with out money since there are undoubtedly a great deal of issues to invest for from the small business.

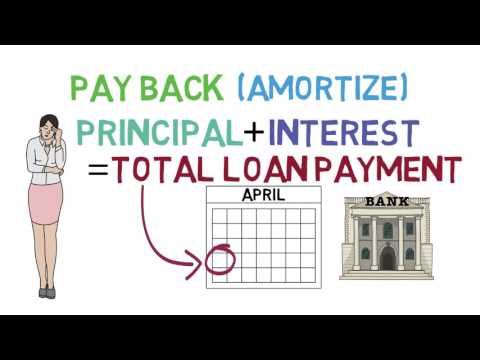

Dollars to spend for small business remains a major concern of individuals. Entrepreneurs have regarded the role of organizing so that money won't a lot become a problem. Receiving loans for machines finance purposes is all too tempting and several corporations make this happen. What is excellent about this method is usually that, you know the way A great deal you will buy many months or two or three years possibly. The amount of money for amortization is identical thirty day period following thirty day period so there is not any trouble in issuing checks for the repayment with the machines loan.

Owning dollars allows a business to generally be more adaptable and more and more people are searhing for providers to give them suitable equipment funding. This is actually the explanation why numerous of such organizations will be able to acquire new equipment, buy overhead fees or other items.

What makes these financial loans much more attractive is because of the simple fact there are online apps for people to use they usually haven't got to attend in very long queues at hand in their programs. The right form of personal loan is offered and customers are provided coaching on what to do. This can be so unlike the method of most banks where by You should wait for a long time for acceptance and eventually, they may opt for to not approve your software. Proprietors of modest corporations stand with lesser probabilities of personal loan approval from financial institutions which has made them get rid of faith within the banking process. Banks Alternatively usually do not desire to possibility their revenue on smaller corporations since There exists a bigger share of having a bad credit history circumstance mainly because of the erratic profits of your self-utilized sector.

So, the borrower obtains much better advantage by obtaining the money necessary to run the small business. What these borrowers like about implementing the equipment finance system is usually that, they will purchase the ideal products and will not must settle for All those with lesser high-quality.

It is significant that you choose to make a record of apparatus you would want and their suppliers. Come up with a comparison of the costs given by these suppliers for applied and new gear. Devices funding will pay for the computer systems as well as other apparatuses. Regardless of how smaller or significant the machines is, There's a corresponding financial loan what would solve the requirement for the company. To be successful in generating the organization run, you need the assistance of machines. Folks will appreciate If you're working with excellent equipment and so, will give more trust to you and in some cases endorse your enterprise to Many others.

Financing offers the payment terms which is convenient for yourself, so you would be capable to Perform your means and use them for other factors in addition.

The Most Common Complaints About Benefits Of Loans , And Why They're Bunk

There are lots of kinds of financial loans, and based upon your credit history score and background and the objective of the financial loan, you have to be capable of finding a loan to suit your needs.

One of the more common types of loans is termed a secured installment financial loan. These are definitely used to finance increased priced products like properties and cars and trucks. A bank or credit score union will lend you the money that you'll want to obtain the home or automobile, then over a time period (normally 5 or 6 several years for cars and thirty decades for homes) you can make standard payments or installments.

Typically, the payments would be the very same total and thanks concurrently every month, and by the tip with the financial loan time period, you should have paid out off the loan and the desire. You'll find, having said that, exceptions to this kind of bank loan composition especially in the mortgage marketplace. Some mortgage loan financial loans are actually create so that the lendee pays a set quantity every month for a brief length of time like two to ten several years. For the duration of this time frame, they only pay back curiosity to the financial loan, and in the event the term is comprehensive, they owe the balance which known as a balloon payment.

This kind of loan is just feasible when house prices are frequently climbing since if your home price falls then the borrower's balloon payment will likely be A great deal more than they will be able to get by providing the house. You can find other vagaries in the house mortgage loan sector like ARMs, or adjustable fee mortgages, exactly where the lender's desire rate improvements two or three a long time into your loan.

Yet another personal loan sort is surely an unsecured personal loan. These https://rigfinance.com.au/us_client/wired/ incorporate money that may be borrowed For additional intangible reasons which implies that these financial loans will not be backed up by an asset like home loans or car loans. Despite the fact that some debt consolidation loans are structured like installment loans in terms of repayment terms are worried, most unsecured financial loans are deemed revolving financial debt. That means that as long as the connection between the lender as well as the borrower continues to be amicable along with the account stays open up that the borrower can repay and reuse their credit As outlined by her or his possess discretion. These mortgage forms include things like credit cards, bank overdraft accounts, and bank traces of credit rating. Generally, these products and solutions have bigger interest rates compared to secured financial loans mentioned previously.

Drawing traits from both equally of the above groups, a HELOC or house fairness line of credit history, can be a revolving personal debt that actually works very similar to a daily line of credit rating but is confirmed by your property fairness that's the industry worth of your home minus the remaining quantity because of with your home finance loan.

Other financial loan forms target borrowers with poor credit history and contain payday financial loans and dollars improvements which offer people speedy income for an exceedingly shorter financial loan expression with really high interest prices.

Those people are The essential different types of financial loans which are available in the present marketplace. Some businesses present A large number of loans in some variety or One more when other providers focus on a couple of mortgage merchandise. Before making use of for a bank loan, seek the advice of a reliable advisor or Experienced from the finance market to be sure that you're obtaining the greatest financial loan for your preferences.

Ask Me Anything: 10 Answers To Your Questions About What To Know About Personal Loans

On the subject of a personal mortgage, you have to first learn to use it responsibly. For the reason that should https://rigfinance.com.au/us_client/wired/ you miss out on a repayment, your credit score might be impacted adversely. And recall, that a credit score is definitely an indicator of how perfectly you handle your personal funds. Also, it plays a defining job after you make an application for any sort of bank loan - secured and unsecured. It can be prompt to make an application for a mortgage a little bit larger sized than what is necessary so that you'll be confident to possess ample cash to pay for all charges vital and still have some money left over to ensure that your bank account stays recent.

A credit rating rating may be outlined as a amount which demonstrates the economic predicament of someone. If the individual is properly-off With regards to economical issues, then she or he is said to have a significant credit score. Conversely, if somebody is the precise opposite of the, then they have a low credit rating rating. There are plenty of aspects which can be regarded as by monetary establishments for the purpose of assessing anyone's credit rating rating - normally, the credit rating scores of people differ from 300 to about 850.

A personal loan is actually a variety of personal loan that may be offered by electronic lenders, banking institutions and credit history unions to aid you with your ideas, be it starting off a little small business, or building a big purchase. Personal loans are inclined to obtain an curiosity level(s) reduce compared to the charge cards; even so, they can also be place to employ for combining several bank card debts jointly into just one regular lessen-Expense payment.

Now, your credit rating is crafted by trying to keep in your mind different parameters from your credit rating experiences. These reports provide the goal of trailing your history of utilization on the credit across the length of seven a long time. These credit history stories are comprised of information, which includes exactly how much credit rating you may have used to date, the sort of credit in your possession, the age of one's credit history accounts, no matter whether one has place in for bankruptcy or liens filed towards them, actions of personal debt collections taken from them, a single's complete open up lines of credit score along with the latest inquiries for tough credit.

Like every other kind of credit history, particular loans are very capable of influencing your credit history rating. This may be finished by the process of implementing and withdrawing a personal bank loan. In case you are curious regarding how own loans can end up impacting your credit, then read on to determine more about the context. There are many ways in which your credit can be impacted by individual financial loans and a number of them are stated down below:

The ratio of your respective personal debt-to-revenue and mortgage

Debt-to-cash flow ratio is thought to be the evaluate of your respective volume of earnings that you spend over the personal debt repayments. In the case of lenders, the quantity of profits that you receive is alleged to generally be among the list of main things proving that you'll be capable of repay your financial loan.

Several of the lenders have think of their own personal personal debt-to-earnings ratio to make sure that their proprietary credit scores may perhaps take advantage of it in the form of the credit score thought. Don't drop into the kind of mentality that possessing a superior degree of a mortgage would harm your credit. The most problems it can do is increase the ratio within your debt-to-money so that you will not likely have the ability to submit an application for financial loans any longer without it obtaining turned down or denied.

Shelling out loans on time could make credit score scores soar

The instant your personal loan is accepted, you may have to ensure that you compromise the payments of monthly in time and in full. Delay in repayment might substantially impression the point out of your respective credit history score. However, Conversely, if you make the payments punctually every month, then your credit rating rating will soar substantial, leading to an overall great score. This could not just make your title to the popular borrower's list, but it will eventually establish to generally be beneficial to suit your needs Over time.

Considering the fact that your payment background is comprised of almost 35% of your respective credit rating score, having to pay loans punctually is essential in conditions like these so that your credit score can manage a optimistic position.

Variety is built into your credit score sort

You will find about 5 aspects which have been chargeable for analyzing your credit rating score. These are made up of the payment history, the size on the credit heritage, the utilization ratio from the credit history, the credit combine and new inquiries of your credit rating in accordance with FICO®.

The credit score mix only accounts for approximately 35% of one's complete credit score score, While In regards to a private personal loan you can have a different combination of the credit score forms. This combination of all kinds of credit score is considered at a superior level of acceptance with the creditors and lenders.

Origination price charged by loans

Most of the lenders end up charging you an origination rate. This cost can't be prevented at any Price tag and is particularly quickly taken off from the quantity of the financial loan payment. The quantity of origination charges is dependent upon the amount of the loan you're going to borrow. Late payments can cause an overdraft of charges and late bills. Therefore, Be sure that you pay back entire repayment for monthly prior to the deadline.

Averting penalties On the subject of payments

Several of the credit history lenders have a tendency to charge an extra cost if you find yourself having to pay your Component of the loan before compared to agreed date. This is because they are looking for moderate quantities of fascination with your loan. Now, looking at that you have compensated off your Section of the loan ahead of time, they can overlook out on that fascination they could have perhaps made when you experienced not cleared the personal debt soon sufficient before the deadline.

13 Things About Get A Truck Loan You May Not Have Known

With the increase in trade and consequent steady motion of goods, vehicles are getting to be essential for varied companies to move Uncooked materials and concluded products and solutions from a single place to another. An entrepreneur could actually cash in on owning a truck and carrying differing kinds of products but vehicles are highly-priced, and may Every person pay for to personal 1?

Except for the couple of hard cash prosperous business owners, most Some others who want to look at buying a truck will go with a truck personal loan. For those who are thinking about a secured truck personal loan, prepare a comparative chart of the companies presenting these financial loans and specially confirm the once-a-year proportion amount (APR) that gives you an idea of the all-inclusive annual desire proportion. Additionally, you will do well to compute your present liabilities and confirm that the new debt for the truck will never overburden you. The new trucks have the benefits of warranty and when you are thinking about purchasing a 2nd-hand automobile, visualize a single that isn't a lot more than four yrs previous, to avail the ideal finance offers.

A truck is undoubtedly an asset whose value dwindles from the working day, on account of which, the moment you buy a truck the bank loan total is greater than the worth from the truck. Very long-time period loans may have reduced repayments than quick-phrase loans. Considering the fact that, most truck manufacturers have their own individual finance affiliate marketers to challenge truck loans, if you employ the same application to pick a truck and its personal loan you stand an improved probability of lessen fascination fees, not to speak of a very good truck at A cost-effective cost.

A secured loan is usually a better option if you'd like to go in for the more expensive truck, and also the fascination ranges from about 7 to 18%. Right here once more you have two forms of loans; the mounted kind mortgage with preset repayment for a particular period of time and a flexible type bank loan using a variable repayment, but for a fixed interval. You could potentially usually Check out with the web site on the company to see if there are any Particular gives on the type of truck that you'd like to order, and verify no matter if you can obtain a loan at 0% fascination, which you frequently see marketed inside the newspapers. If you are thinking about buying a second-hand truck, you can confirm the desire for this type of mortgage. Verify up also whether or not you may get 1 at 0% curiosity.

The net gives you an abundance https://rigfinance.com.au/us_client/wired/ of scope for carrying out important investigation on secured truck financial loans, which will vary with the sort of the car, mortgage interval, your credit ranking along with your First deposit from the personal loan. You may also consider an auto lease to avail small down-payments. You should even so, hold a watchful eye for conditions that obligate you to pay the hidden early redemption penalty.